Post by Andrew Waters, Project Director, and Kathryn Obenshain, Research Assistant at the UNC EFC

There’s an old adage about a brand-new car dramatically losing value the moment it’s driven off the lot. In this crazy economy, where the value of used cars has skyrocketed, the adage may not be as true as it once was. However, the premise is still the same. Once something is “used”, its value decreases, often in a linear progression, as the effects of normal wear and tear accumulate over the years.

In terms of financial reporting and planning for a utility or organization, this phenomenon is known as depreciation. Depreciation affects the utility’s property, plant, and equipment (PP&E) assets, excepting land. This could mean anything from a water tower or treatment plant to a pipe or vehicle. Over time, these aging assets lose both usefulness and value. Depreciation is the standard method to account for this decline in financial reporting. In financial terms, depreciation is a non-cash business expense that is allocated over the useful life of the asset. However, depreciation should be accounted for in your financial reporting as soon as the asset is acquired and applied consistently over its lifetime. For management purposes, depreciation is an effective method for tracking the lifespan of capital infrastructure and planning sustainably for its replacement or upgrade.

There are different methods for computing depreciation. The chosen method depends on the asset that is depreciating and how quickly its value is expected to decline. A few key terms for calculating depreciation include the lifespan and the salvage value of the asset. Lifespan is the asset’s useful life. Salvage value is the asset’s estimated book value after depreciation is complete. There is no perfect way to estimate these values, and what’s on the books may not be a perfect representation of what is happening in the facility or the field. The IRS provides some general guidelines on how to estimate depreciation in IRS Publication 946. However, in some cases, calculating the asset’s useful life and salvage value may be a best-guess estimate.

The most popular method for computing depreciation is the straight-line method, where the annual depreciation expense remains constant over the asset’s estimated lifespan. Annual depreciation is deducted from the asset’s book value year to year, until the asset’s book value equals its salvage value (if any). To employ this method, compute the asset’s depreciable cost and annual depreciation expense, as in this example:

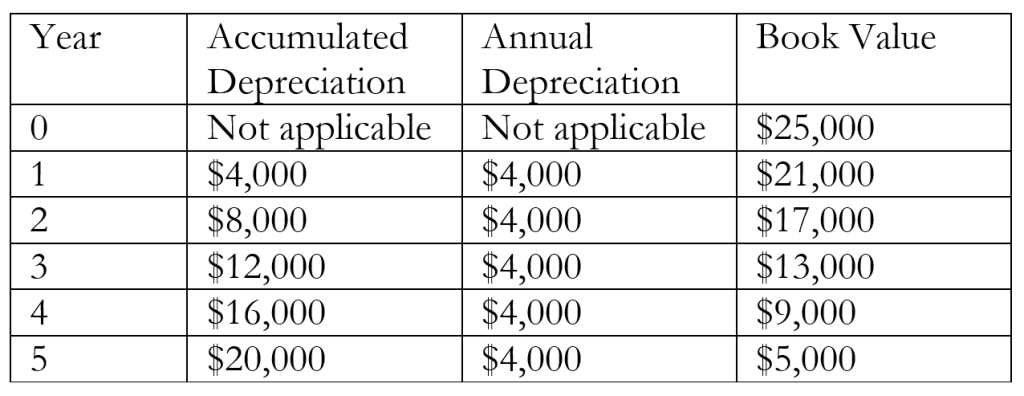

Consider an asset acquired for $25,000 with an estimated lifespan of 5 years and a salvage value of $5,000:

Cost – Salvage value = Depreciable cost

$25,000 – $5,000 = $20,000

Depreciable cost ÷ Lifespan = Annual depreciation

$20,000 ÷ 5 = $4,000

At the end of Year 5, the asset’s book value reaches its salvage value. Moving forward, the asset remains on the financial statement at salvage value without further depreciation until it is replaced.

There are various methods of depreciation, depending on the nature of the asset or the specific business model, and depreciation can be recorded differently for book and tax purposes. Depreciation information kept for internal financial management and planning may not necessarily be the same as what gets reported to the IRS as firms try to maximize tax benefits. What’s important is consistency. Once a method is selected, it should be retained from year to year.

Depreciation is a useful tool for sustainable financial management. Although depreciation may or may not reflect the “true” value and condition of capital infrastructure, it is a useful measure for determining whether enough revenue is being collected and saved to replace that infrastructure over time. One way the UNC EFC uses depreciation is in calculating a client’s operating ratio, which is the annual operating revenue divided by annual operating expenses. An operating ratio of one means that a utility brought in exactly enough annual revenue to cover annual expenses. Including the rate of annual depreciation in annual operating expenses enables the operating ratio to capture an estimate of the lost value of aging infrastructure, which allows the utility to plan and save for that infrastructure’s upcoming replacement.

Of course, financial metrics such as depreciation and operating ratio are reflections of financial data and are not based on the actual assessment of asset condition by engineers. Selecting which assets may need to be replaced or upgraded should be determined only after a thorough physical inspection, ideally as part of an asset management plan. However, when combined with other financial tools and analysis that can be provided by the UNC EFC, depreciation estimates can be an important measure for successful and sustainable financial planning for a utility and its infrastructure assets.

Need technical assistance? The UNC Environmental Finance Center is here to help!

The Environmental Finance Center at UNC-CH offers free one-on-one technical assistance for small water systems. If you have an interest in our support, fill out our interest form here or contact mullins@sog.unc.edu.

Visit https://efc.sog.unc.edu/technical-assistance/ to read more about technical assistance.

One Response to “Appreciating Depreciation”

Alan

I love the title. Very well explained article and easy to understand. Thanks for sharing.