Casey Wichman is an Environmental Economics Analyst with the Environmental Finance Center.

In case you haven’t heard, the merger between Duke and Progress energy was approved, making it the largest power utility in the United States with approximately 7 million customers in the southeast and midwest. If you did hear about that, you are probably also aware of the executive shuffle for control of the new company between Jim Rogers, former (and now current) CEO of Duke Energy, and Bill Johnson, former CEO of Progress Energy who held the reins at the new company for mere minutes.

Other than reinforcing the common opinion that big power companies are deceptive, power-hungry entities, what does this mean for retail electricity customers of the new company? On one hand, the new Duke will pass on $650 million in savings to NC customers, contribute $33.5 million to charitable groups and assistance for low-income customers annually, while protecting them from merger-related costs, which will be borne by investors. Additionally, the operating efficiencies of the new company, by combining production facilities and more investment in natural gas and nuclear power plants, will purportedly result in smaller rate increases in the future.

On the other hand, Duke Energy is expected to seek rate increases later this year to recover the costs of new power plants and other capital investments in addition to the 7.2% rate increase, down from the initially proposed 17% increase, which went into effect earlier this year.

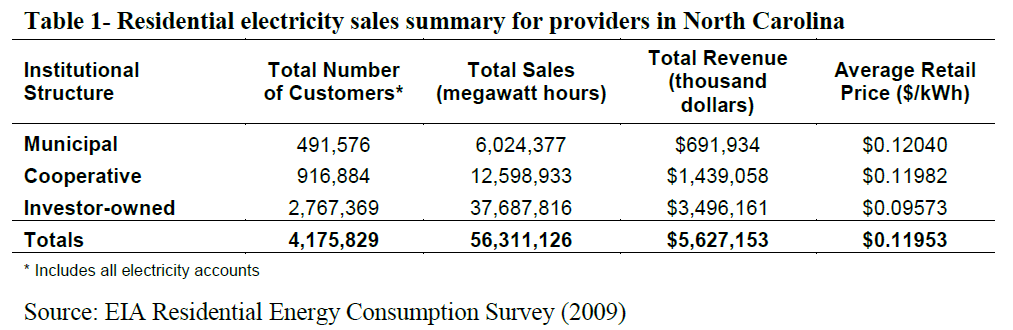

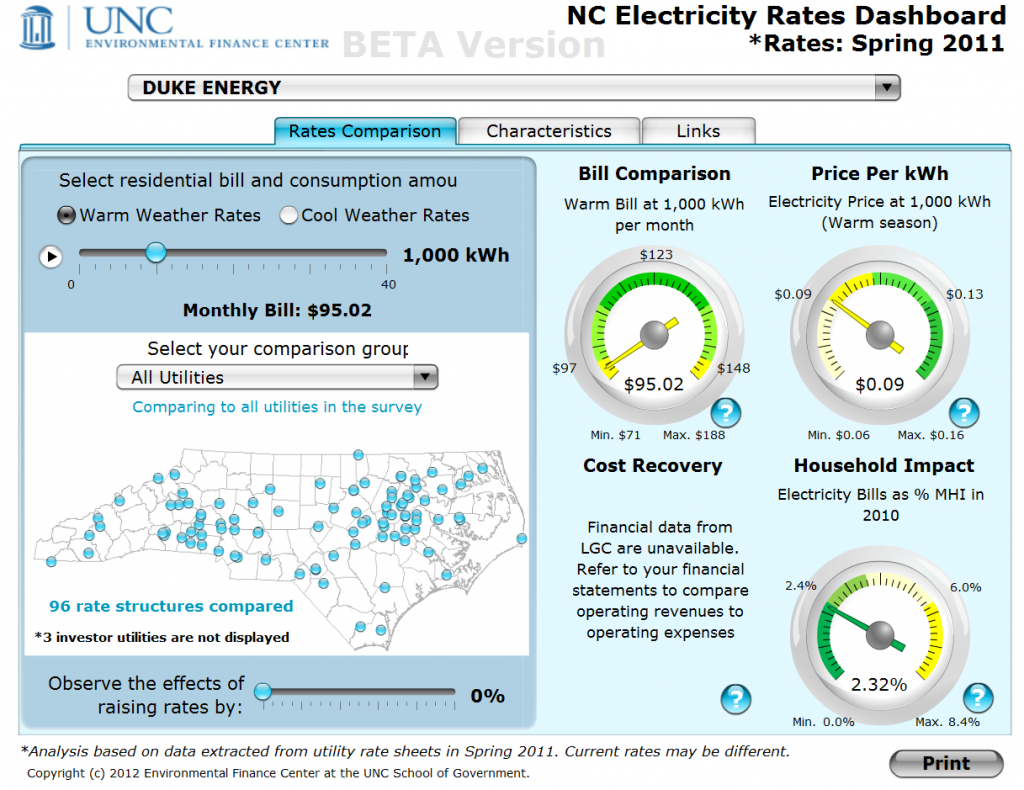

Residential customers in NC can, however, rest assured that electricity rates for investor-owned utilities are some of the lowest in the state, according to a 2011 report from the Environmental Finance Center. While a residential customer doesn’t have much say in who they buy their power from, the EFC’s newly released NC Electricity Rates Dashboard allows for unique rate comparisons along different utility characteristics.

Residential customers in NC can, however, rest assured that electricity rates for investor-owned utilities are some of the lowest in the state, according to a 2011 report from the Environmental Finance Center. While a residential customer doesn’t have much say in who they buy their power from, the EFC’s newly released NC Electricity Rates Dashboard allows for unique rate comparisons along different utility characteristics.

Compared to all other municipal and cooperative utilities, the typical residential customer serviced by Duke Energy has a monthly bill in the lowest 10th percentile among all utilities in NC. Even in a simulated 15% rate hike scenario, Duke’s bills for average customers comprise less than 3% of annual income, which is less than the median of North Carolina utilities with similar service populations.

With less competition due to the Duke-Progress merger, the trickier question to answer is: what will happen to the price of electricity purchased at the wholesale level? Both electric cooperatives and NC Public Power, the umbrella organization for municipal utilities, have purchase agreements with Duke and Progress that they rely upon to meet their customer’s demand. Any additional cost of wholesale power will be transferred onto the customers of the smaller utilities who already face higher-than-average electricity bills.

As the business operations of the new Duke Energy will be monitored closely, it is important to make sure that progress for Duke is progress for North Carolinians, as well.

One Response to “Big Power: Duke Energy’s Progress”

Michael Chasnow

Interesting that Duke’s rates are among the lowest across the North Carolina, and would be even with a 10-15% rate increase. It will be interesting to see how the mergers affects NC co-ops and residential customers going forward.