In North Carolina, and around the country, growth in the deployment of solar photovoltaic (PV) power has accelerated dramatically in recent years. However, from the standpoint of financing the provision of electric power to customers, this growth in solar deployment presents challenges to the traditional business models of investor-owned utilities (IOUs). How will the electric power industry adapt in the coming years, especially from the standpoint of sustainable financing of clean energy?

Growth of Solar Power Deployment in North Carolina and the United States

One Chapel Hill-based solar company announced last quarter that it has invested $1 billion to date in N.C. solar energy, including 65 solar facilities in 40 counties, employing 2,000 workers during the past five years, and bringing 350 megawatts (MW) of solar energy online. And last month it was reported that North Carolina now ranks third in the United States for new solar power capacity installed in 2013.

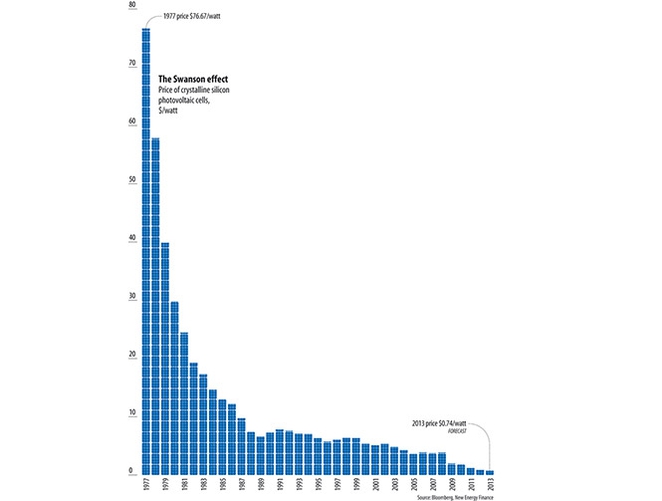

With Duke Energy’s December 2014 announcement that it has acquired a sizeable solar energy project in Rocky Mount, N.C., multiple power purchase agreements (PPAs) between Duke and solar power generators around the state, and Duke’s announced plans to spend $500 million to build solar power installations or purchase the power from other sources, North Carolina’s trend towards greater solar deployment may continue. This trend is propelled by the N.C. Renewable Energy and Energy Efficiency Portfolio Standard law, with its solar power set-aside requirements (e.g. the state’s requirement that IOUs earn 12.5 percent of their sales from renewable energy or energy efficiency by 2021). Perhaps even more importantly, the plummeting cost of solar power production is driving this development forward, with the cost per watt of solar power declining by a factor of more than 100 times since 1977, to an estimated $0.74/watt in 2013:

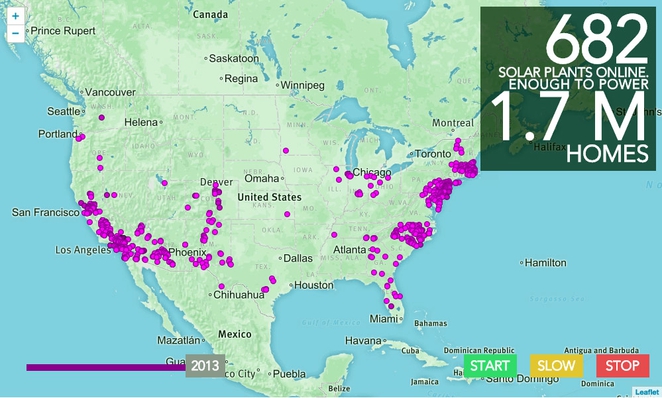

These and other trends have resulted in the U.S. seeing a 1,200% increase in solar plants that generate 1 MW or more between 2008-2013, with much of that located in N.C:

Hence between 2008-2013 the U.S. added about 6,000 MW of solar power generation capacity, a significant increase.

Challenges to Existing Electric Utility Business Model from Growth of Solar Power

However, by no means is all growth in electric power production controlled by the IOUs. In addition to centralized solar power plants owned and operated by IOUs, as well as PPAs with centralized solar plants owned by developers, there is also the distributed generation model, a.k.a. “rooftop solar,” where homes and businesses install solar power on their roofs, or elsewhere, and sell any excess power they generate (beyond their own usage) back to the grid by means of “net metering” arrangements with the IOUs or other local electric utilities. This distributed generation model allows more people to “get into the solar business,” but it also presents challenges to the utilities that buy their electrons in terms of successfully managing their existing capital stock and following their traditional business models.

As reported by NPR last month, solar energy had another big year in 2014; but as more American households make their own electricity, they are in turn paying less to electric utilities. With these utilities still having large generating stock, as well as transmission and distribution assets that require capital financing across time, utility companies across the nation are starting to fight back against accelerating solar distributed generation.

In northern California, where a quarter of all the rooftop solar systems in the country are located, companies like Pacific Gas and Electric (PG&E) are concerned by the growing number of homeowners buying less power from the grid while simultaneously selling more surplus power back to the grid where the IOU must buy it at a contracted rate. PG&E states its belief that rooftop solar producers are not doing enough to pay for their share of keeping up the electrical transmission and distribution infrastructure that the IOUs must maintain, claiming that rooftop solar producers “use the grid more than almost anyone because they’re selling power back into it,” according to Jonathan Marshall, a PG&E spokesman. Hence several California companies are proposing a change to attempt to make up lost revenue: a fixed monthly charge that all customers would pay of $10/month. This proposed fee strikes solar companies such as SolarCity (the largest solar company in California) as a direct attack on their own business model. Sanjay Ranchod of SolarCity asserts that the extra fee would make solar a harder sell for the firm, at a time when more states are trying to encourage solar energy production.

So where might the solar power generation business go from here?

Possible Alternative Business Models for Electric Utility 2.0

Given the disruptive effects of distributed solar on the traditional electrical utility business model, as well as other forms of renewable energy such as wind power, there are substantial and growing questions about the future business model for electric IOUs and other providers. What will Electric Utility 2.0 look like 10, 20, or 30 years from now?

Glossing over admitted existing problems with solar power such as intermittency, and the still immature, but evolving, state of electric power storage technology, Electric Utility 2.0, as it relates to the growth of distributed solar, might see a potential “death spiral” of utilities raising rates and fees (as utility commissions and other rate-setting bodies allow, that is) as their revenues from sales go down; which in turn depresses demand and encourages more rooftop solar; and so on. This may not be a sustainable business model.

But what if the utility’s revenues were “decoupled,” at least in part, from the amount of its sales of electrons to its customers? What would this mean, and how might it work? As defined in the US EPA’s 2007 document, “Decoupling For Electric & Gas Utilities: Frequently Asked Questions (FAQ),” the term refers to:

“Decoupling” (or “revenue decoupling”) is a generic term for a rate adjustment mechanism that separates (decouples) an electric or gas utility’s fixed cost recovery from the amount of electricity or gas it sells. Under decoupling, utilities collect revenues based on the regulatory determined revenue requirement, most often on a per customer basis. On a periodic basis revenues are “trued-up” to the predetermined revenue requirement using an automatic rate adjustment.

Such a decoupling electric utility business model might take many forms, whether partial or full decoupling is tried. For example, California has already experimented with “revenue-cap decoupling,” whereby the utility is allowed to collect its exact revenue requirement, without deviation. This requirement is not “trued up” between rate cases before the PUC, in this instance. This and other full or partial methods of decoupling are discussed in greater detail by an old graduate school colleague of mine, Elizabeth Watson, in her 2010 masters project on “Electric Utility Decoupling in North Carolina: Removing Disincentives for Energy Efficiency.”

As another alternative, the shape of Electric Utility 2.0 might move away from the vertically integrated model that is common today: an IOU generates electricity, transmits and distributes it to customers, collects revenue from these sales, and uses it to maintain and upgrade the system, as well as to return profits to investors. But what if the transmission and distribution (T&D) side of the business were separated from the generation side? Then T&D electric utilities could focus on making their niche of the business as efficient and profitable as possible, regardless of what disruptive changes were happening to the generation side of the industry. And as it happens, the recent approval in December 2014 by the Federal Energy Regulatory Committee of the ongoing attempt by Duke Energy to purchase the generation assets of the members of the North Carolina Eastern Municipal Power Agency (NCEMPA) may, in effect, put NCEMPA in a position to do exactly that, since their T&D assets are not part of the proposed sale.

In any event, while the future shape of Electric Utility 2.0 is far from clear today, with the projected worldwide boom in solar power generation (including both centralized and decentralized), the International Energy Agency predicts solar power will supply about 30 percent of the world’s electricity needs by 2050, which would presumably make it the top power production technology in use worldwide. Hence the challenges raised by solar power may well continue to push the electric power industry to evolve its business models, as well as its technology.

David Tucker is a Project Director at the Environmental Finance Center at UNC Chapel Hill.