Earlier this week, Lawrence Berkeley National Laboratory (LBNL) released a technical brief, “Energy Efficiency Program Financing: Where it comes from, where it goes, and how it gets there.” Financing specifically refers to capital that is used to cover project upfront costs but then paid back over time (unlike rebates or other incentives). This characteristic of financing programs also makes them ideal tools to amplify the impact of limited amounts of public funding for energy efficiency, by recycling the funds as they are repaid for further projects, and by using the public funds to attract greater amounts of private capital.

The research highlights several intriguing (but expected) takeaways and a few surprises, but bypasses one key insight.

Here are the interesting findings the brief brings to light:

- Financing programs lent $4.8 billion for energy efficiency in 2014, across five types of programs:

- On-bill financing and repayment

- Utility financing programs (not paid back on-bill)

- Property Assessed Clean Energy (PACE) financing

- State energy office (SEO) revolving loan funds (RLF)

- Energy savings performance contracts (ESPC) (for more detail on what each of these types of programs entails, take a look at page 3 of the report).

- The ESPC category is about 85 percent of that total amount, with the other four types of programs representing $700 million in 2014

- About 65 percent of investment is aimed at electric efficiency (rather than other types of fuels)

- Some type of program is available in most states and in most sectors, although not in all

- The public /institutional sector is largely served by ESPC and a little bit by SEO RLFs, while the commercial /industrial sector is served by ESPC and on-bill programs, and the residential sector primarily participates in utility financing and PACE programs

- Many of the programs studied involve public capital of some kind, such as State Energy Program (SEP) funds, or Energy Efficiency and Conservation Block Grant (EECBG) money available through the American Recovery and Reinvestment Act (ARRA)

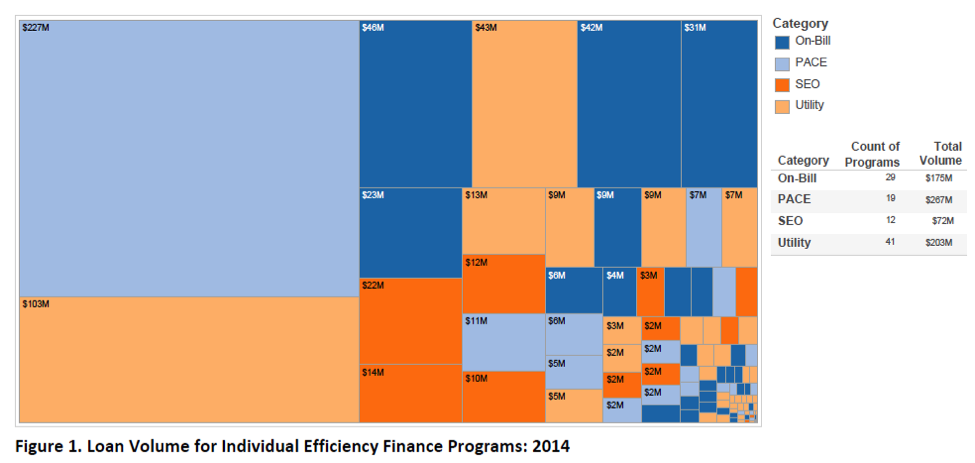

Those are all pretty standard facts we would expect to find in this brief. Here’s where the surprising parts come in: Two large programs accounted for 46 percent of the $700 million in non-ESPC energy efficiency financing programs, with the five largest programs accounting for 65 percent of that figure.

The diagram below makes this statistic even starker. We can clearly see the five largest programs – the California HERO program, Mass Saves HEAT loan program, the Tennessee Valley Authority’s Energy Right Solutions program, New Jersey’s Clean Energy Program, and the California investor-owned utilities’ on-bill financing program – taking up more than half of the total.

The next surprising piece relates to credit enhancements and interest rate buydowns (IRBs), which the LBNL report does not include in their totaling of energy efficiency financing programs. Credit enhancements (such as loan loss reserves) and IRBs reduce interest rates for customers. These involve the commitment of capital, but not the loaning of that capital, which is why they’re not included in LBNL’s totals. However, the brief did examine these types of programs, and found that the larger, non-ESPC programs (like the five mentioned above) are more likely to include credit enhancements or IRBs. It’s difficult to determine if this is the chicken or the egg: Does offering IRBs and credit enhancements result in programs that attract more demand, or do larger programs carry extra risk that requires additional protections for lenders? In either case (or a little bit of both), credit enhancements and IRBs attract private investors, so it’s likely that programs offering these benefit from the amplifying power of private capital.

And that’s where the report misses an opportunity to take their analysis one step further. Given that the goal of so many of these energy efficiency financing programs is to leverage small amounts of public capital to attract greater amounts of private capital, how are programs performing overall on this metric?

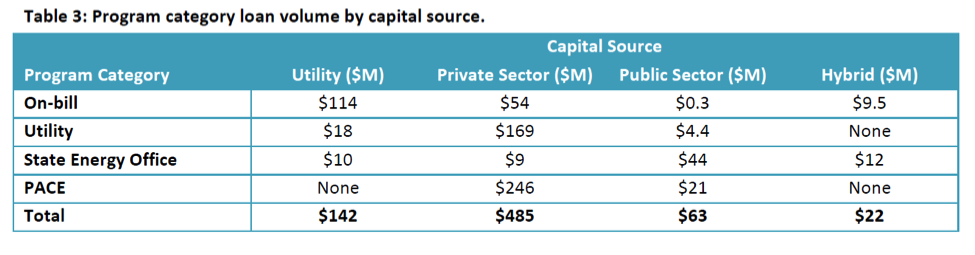

LBNL categorized the source of lending capital for the non-ESPC programs analyzed, and this broke down according to the table below:

Let’s set aside hybrid capital sources, which mix two or more of the other capital sources in secondary market transactions, and account for a small piece of the overall picture. Taking the numbers in the different categories in the table above and placing them in relation to one another, the leverage ratios of different sources of capital by program are as follows:

| Program

Category |

Private Sector : Utility + Public Sector | Utility Sector : Public Sector | Private Sector : Public Sector |

| On-bill | 0.5 : 1 | 380 : 1 | 180 : 1 |

| Utility | 8 : 1 | 4 : 1 | 38 : 1 |

| State

Energy Office |

0.2 : 1 | 0.2 : 1 | 0.2 : 1 |

| PACE | 12 : 1 | ||

| Total | 2 : 1 | 2 : 1 | 8 : 1 |

With this, a picture starts to emerge of which types of programs are successfully leveraging which types of dollars. On-bill and utility financing programs with funding from the public sector are very successfully attracting private capital, at 180:1 and 38:1 respectively. PACE programs (which are not funded by utilities) are doing reasonably well, leveraging private capital 12:1 with public dollars. It’s not surprising that State Energy Office programs show little in the way of leverage, since these are revolving loan funds set up with largely state funding. A 2:1 leverage ratio across the board of private sector funds to utility and public sector funds suggests that programs with funding from utilities do not seek or do not attract private dollars. Similarly, a 2:1 leverage ratio for utility funds to public sector funds (with a whopping 380:1 leverage ratio for on-bill programs) shows that programs with utility funding do not make use of public capital.

But overall, energy efficiency financing programs are leveraging private dollars 8:1, or said another way, attracting $8 of private capital for every $1 of public funding. If we remove State Energy Office programs, which have little private sector involvement by nature, from the mix, the result is an 18:1 leverage ratio, or 18 private dollars spent for every one public dollar.

The programs analyzed here are therefore doing an incredibly successful job of attracting private funding with limited amounts of public funding. On top of all of the other interesting and surprising facts in this LBNL brief, that is a pretty amazing conclusion.