Jen Weiss is a Finance Analyst at the Environmental Finance Center.

Yes, energy efficiency is the low hanging fruit of the energy world. And yes, the southeastern United States has even been referred to as the Saudi Arabia of energy efficiency (a quote originally attributable to Dr. Marilyn A. Brown, a Nobel Peace Prize winner and a Professor at Georgia Tech’s School of Public Policy). And yes, it would seem likely that homeowners in the hot, humid southeastern states would be jumping at any chance to reduce their high utility bills during the hot summer months. But for some reason, despite all indicators pointing to “yes,” homeowners in many areas of the country have given a clear response of “no” when presented with an opportunity to finance energy efficiency retrofits with low-interest rate loans. Which is leaving many analysts in the finance industry, including myself, scratching our heads and wondering “why don’t more homeowners take advantage of these great, low rates?”

The U.S Department of Energy estimates that residential and commercial buildings consume over 40% of the energy and represent almost 40% of the carbon emissions in the United States.[1] It is widely believed that improving the energy efficiency in buildings represents one of the easiest, most immediate and most cost effective ways to reduce carbon emissions and save money on energy bills. To stimulate investment into building efficiency, the Department of Energy invested over $6 billion in state and local energy efficiency programs in 2009 under the American Recovery and Reinvestment Act including $508 million in the Better Buildings Neighborhood Program. Designed to encourage homeowners to invest in energy efficiency upgrades to their homes, funds from the Better Buildings program were used to establish grants, rebates and low-interest loan programs in 41 communities throughout the United States including 16 communities and two state energy programs in the southeast.

The Southeast Energy Efficiency Alliance (SEEA) administers the majority of the Better Buildings programs in the southeast through a consortium of partners within local governments, non-profit organizations and utilities. These innovative programs include the Worthwhile Investments Save Energy (WISE) programs in Chapel Hill, North Carolina, Charleston, South Carolina, Huntsville, Alabama and New Orleans, Louisiana; the LEAP program in Charlottesville, Virginia; the ShopSmart program in Jacksonville, Florida; and the Energy Works program in Nashville, Tennessee. Most SEEA programs offer rebates and other incentives to homeowners completing energy efficiency retrofits and a number of programs have also established loan loss reserves, revolving loan funds, or interest rate buy-down programs to help create below-market rate energy loan programs – with some rates as low as 3.99 percent. But while the rebate and incentive programs have successfully incented over 2,500 residential energy efficiency upgrades across the southeast, the number of loans provided has been less than 5 percent of the number of energy upgrades completed:

| SEEA Southeast Consortium | |

| Number of residential evaluations completed |

4,674 |

| Number of residential energy upgrades completed |

2,524 |

| Number of low-interest loans provided |

122 |

Based on reporting through December 31, 2012.

At the outset of many of these programs, there was a “Field of Dreams” hope that “if you build it they will come.” However despite interest rates that range from 3.99 to 6 percent, homeowners appear to be slow to take on additional debt to finance energy efficiency improvements. Given the economic conditions facing many communities and households, cautious spending is not surprising. Some program administrators also speculate that low uptake with loan programs may be due to a preference to fund improvements with cash. Some may just favor the simplicity (albeit higher interest-rate) of a credit card. Another reason offered is an inadequate understanding of the available loan programs at the time of first contact with a contractor. And then, there is always marketing to blame (or the lack thereof).

Research in the area of creating overall demand for energy efficiency programs – such as the Lawrence Berkeley National Laboratory’s 2010 report on “Driving Demand for Home Energy Improvements” – has consistently stressed the need to involve contractors in the development and marketing of successful energy efficiency programs. While low-interest loan programs have little influence over consumer economic worries, they can play a role in helping a contractor responsibly market retrofit programs. The stakes in communicating the financial impact of energy efficiency improvements are high – over stating or misrepresenting financial benefits could lead to disappointed clients and under selling financial benefits may take away one of the key reasons homeowners consider energy retrofits.

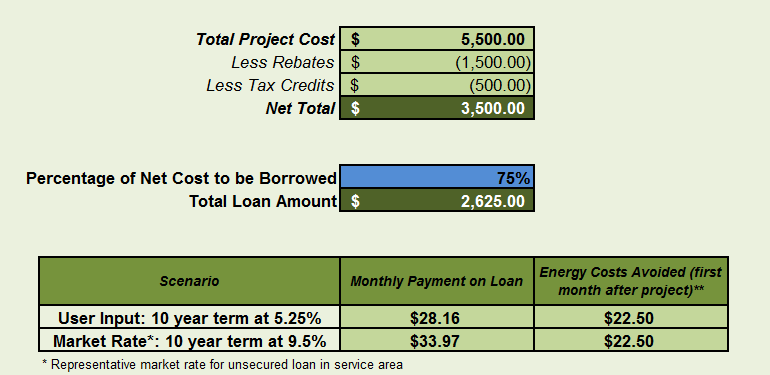

Making the loan decision simple and convenient at the point of first contact appears to be a key to a successful loan program. The Environmental Finance Center has developed loan calculator tools that can be used by contractors and program administrators to summarize the total project costs, the energy costs avoided, the incentives and tax credits available and the monthly payment on the loan. This enables the homeowner to have a snapshot of all of the financial implications of the project in one place:

But while low interest rates are enticing and improved education and marketing might increase loan applications, in the end it is more than just a financial decision that determines whether a homeowner is ready to tackle an energy efficiency project. In the recent ACEEE report, “Trusted Partners: Everyday Energy Efficiency Across the South,” the authors point out that “there is a critical need to understand the social and cultural forces acting on an individual’s decision making” when considering whether to invest in energy efficiency projects. There are many reasons that a homeowner might decide to move forward with an energy upgrade to their home, saying “yes” to a financing decision is only one of them. As one SEEA program administrator observed, “Financing is not the lever to promote energy efficiency. It is essential, but alone not sufficient to the success of the program.”

[1] Energy Information Administration Buildings Energy Data Book. http://buildingsdatabook.eren.doe.gov

Why do homeowners say no to #energy #efficiency retrofits with low-interest rate loans? Getting to Yes: http://t.co/z4iYTw2yHy

— Envr. Finance Center (@EFCatUNC) October 15, 2013

One Response to “Getting to Yes? Energy Efficiency Loan Programs in the Southeast”

Funding Solar PV Installations on College Campuses: Appalachian State University Explores a Buy-All, Sell-All Power Purchase Agreement (PPA) « Environmental Finance

[…] is a topic of growing importance. One way to go about this is to employ any of a wide variety of energy efficiency measures. Another approach is to take advantage of opportunities for renewable energy generation, […]