Post by Hope Thomson, Project Director at the UNC EFC

The past few years of the global COVID-19 pandemic has certainly had its impact on all sectors of society, including water and wastewater utilities. An early 2020 report by Raftelis and the American Water Works Association (AWWA) projected that drinking water utilities were at risk of losing $13.9 billion in revenues due to the pandemic while the National Association of Clean Water Agencies estimated that wastewater utilities were at risk of losing $12.5 billion (NACWA 2020). In communities with large commercial or industrial sectors, revenue losses for wastewater utilities were expected to be even more severe. Thankfully, losses were not as severe as originally anticipated in many cases, though they were still significant. Hopefully another global catastrophe is not imminent, but unexpected events do occur regularly and can negatively affect utilities and the communities they support. What can a utility do when facing a global pandemic, a natural disaster, or other circumstances impacting their financial stability? Turn to their reserve fund, of course.

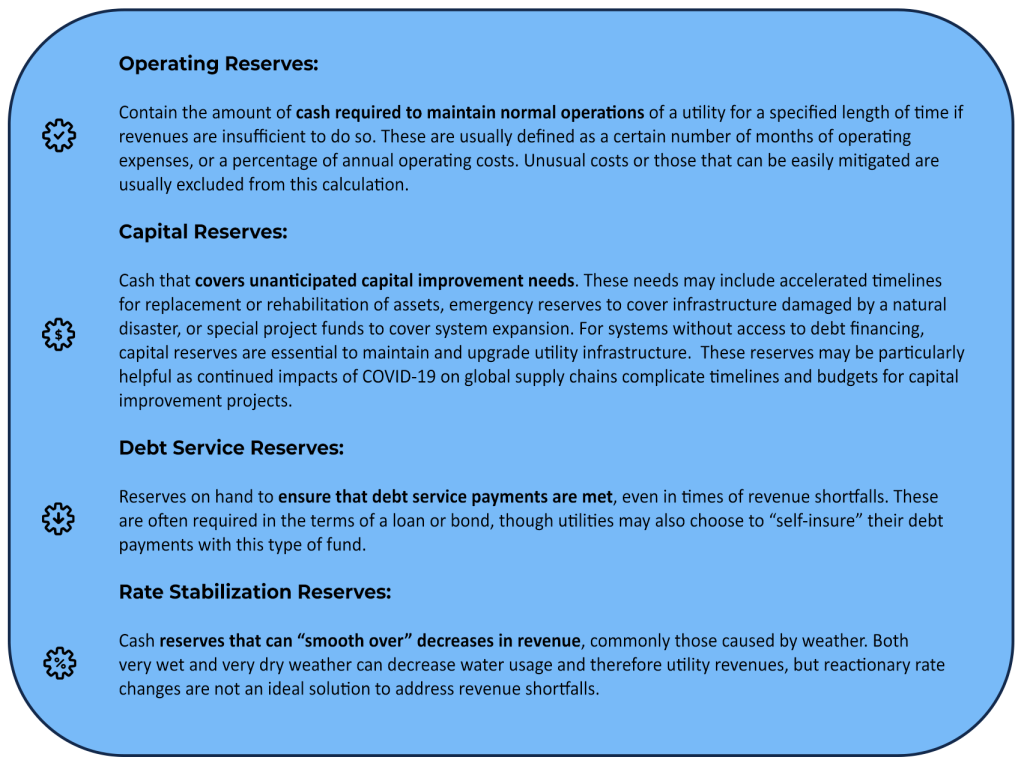

Reserve funds build up over time from excess revenues and can be used for various purposes, often to address unforeseen budgetary strains. Revenues in particular can be highly variable year to year due to population changes, weather, or other factors influencing water use, but unexpected expenses, such equipment severely damaged by a hurricane, can also occur. Reserve funds are a funding strategy that offers stability. The severity of changes to revenues or expenses is highly uncertain, so utility resilience can be improved by considering the purpose of various reserve funds when planning for potential financial shocks. In a 2018 report, AWWA describes 4 basic categories of reserve funds: operating, capital, debt service, and rate stabilization.

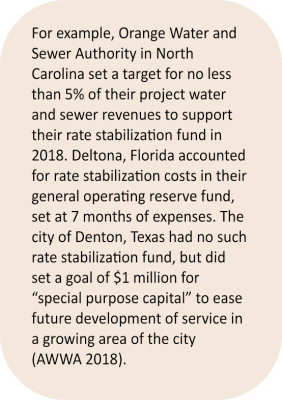

Utilities may “lump” all of these reserves together into a singular fund for flexibility to address multiple types of challenges or “split” their reserves into separate accounts for each purpose to increase transparency and protect the funds for those specific needs. Whether the fund is lumped or split as well as fund targets may be determined by a utility’s board or local government, be required by state law, or be set by the terms of a bond and/or loan. In creating a target for a utility’s reserve fund, consideration should be given to the purpose of the reserve, as well as how any required rate increases to generate such reserves will impact customers. Recommendations for targets can vary substantially, so setting a target reserve amount should be informed by a utility’s current rates, debt service, capital improvement projects, and other individual needs and liabilities.

The practice of generating reserve funds may also be subject to factors outside of a utility’s control. For example, rate increases that would provide excess revenues to populate a reserve fund may be restricted by a utility commission. Financial policies governing these reserve funds should be explicit about where funds can be directed, as more flexible, unrestricted funds could be tapped for a different community need than what the utility originally intended.

A good place to get started with reserve funds may be an operating reserve fund to cover the day-to-day expenses required to maintain the highly reliable service often expected of utilities. Consider setting a target that will cover a reasonable decline in revenues for enough time to mitigate the circumstances creating this loss. For example, short-term resilience could be achieved by reserves sufficient to cover for 3-4 months of O&M expenses; longer-term resilience should cover a year’s worth of O&M expenses. UNC EFC offers a financial resilience dashboard tool to help start the process of assessing financial vulnerabilities at your utility. Most importantly, reserve funds should be built early, before there are signs of problems in a utility or its community. Expect the unexpected and plan accordingly!

Need technical assistance? The Environmental Finance Center is here to help!

The Environmental Finance Center at UNC-CH offers free one-on-one technical assistance for small water systems. If you have an interest in our support, fill out our interest form here or contact mullins@sog.unc.edu.

Resources

American Water Works Association. (2018). Cash Reserve Policy Guidelines. https://www.awwa.org/Portals/0/AWWA/ETS/Resources/awwacashreservepolicynew.pdf

Raftelis & American Water Works Association. (2020, April 14). The Financial Impact of the COVID-19 Crisis on U.S. Drinking Water Utilities. Water Industry Technical Action Fund of AWWA.

https://www.amwa.net/system/files/linked-files/AWWA-AMWA-COVID-19_Report_2020-04.pdf

National Association of Clean Water Agencies. (2020). Recovering from Coronavirus: Mitigating the Economic Cost of Maintaining Water and Wastewater Service in the Midst of a Global Pandemic and National Economic Shut-Down. https://www.nacwa.org/docs/default-source/resources—public/water-sector-covid-19-financial-impacts.pdf