Jeff Hughes is the Director of the Environmental Finance Center.

Ask any utility manager to list the top business drivers and the “R-word”, Regulation, is likely to be near the top. Given the financial implications of many regulations, it’s not surprising that concern for regulation dominates utility management strategy. Concern for regulation was cited as one of the top ten trends to watch in the Water Research Foundation’s recent “Forecasting the Future” report.

The regulations that seem to get most the attention generally fall into the category of environmental regulation – external requirements placed on the environmental performance of a utility. However, there is another type of regulation that has a significant impact on many utilities’ business model and their ability to implement various pricing and financial practices — economic regulation. Economic regulation includes the requirements, limits, and controls on a utility’s finance and pricing practices and for some utilities drives what they can and can’t do on their path to financial resiliency.

While most utilities have flexibility and freedom to design their business model and implement a wide range of locally customized rate setting and fiscal policies, there are critical external (to the utility) economic regulatory factors that influence pricing strategies and fiscal practices. As part of a large on-going research project for the water research foundation on business models and pricing, our research team has studied different economic regulatory models and assessed the impact external economic regulation plays in guiding pricing and financial resiliency for project utility partners and in select states. Our analysis focused on North American approaches, however it is important to point out that this is an area of utility management that has been studied extensively internationally. For example, the United Kingdom’s water management culture is founded on a national economic regulatory system and regulator (Office of Water, aka OFWAT) that has been the target of study for years and is quite different than the prevailing model governing most North American utilities.

The degree of what is covered by an external economic regulatory system varies and may include review and approval of rate modifications; review and approval of significant capital investments; limits or control on specific pricing practices, or general oversight of utility financial health.

Historically, economic regulation has been driven by the goal of protecting consumers from the adverse impacts of monopolistic practices, however some of the emerging pricing regulation can be attributed to more general public policy goals. For example, water utilities in recently drought prone metro Atlanta area must have a three-tier “conservation” rate structure as part of their regional water supply plan compliance requirements.

Example of economic regulation being studied include:

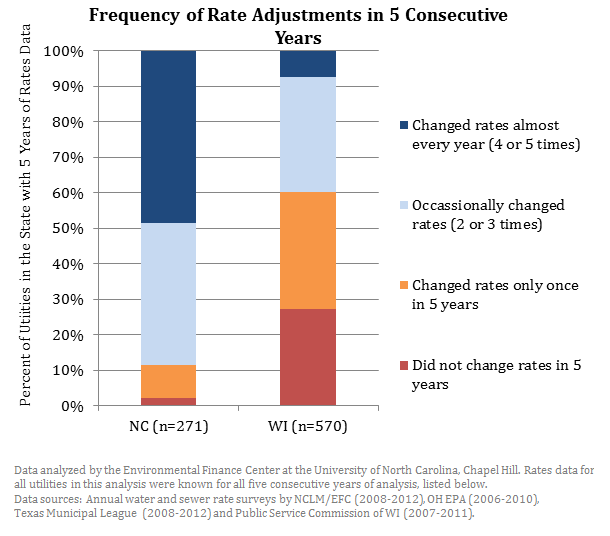

Comprehensive State Economic Regulation

State utility and public service commission regulations vary from state to state, but in most cases, commissions control pricing levels and pricing structures of investor owned water utilities. Utility commissions also influence the ability of utilities to generate funds to maintain different types of reserve funds. Finally, many commissions play a major role in determining, what if anything, a utility experiencing unplanned revenue drops due to reductions in sales can do in terms of implementing special surcharges or other decoupling practices. Figure A shows the impact of regulation on local government utility pricing in two states with different economic regulatory frameworks. The Public Service Commission of Wisconsin oversees investor owned and governmental rate setting whereas, in NC local government utilities are “self-regulated” by their governing boards.

State Pricing Limitations

State economic regulation is not limited to public service commissions. In some cases, general local government finance laws or policies can play a major role in rate setting. For example, several of our partner utilities are based in California and must comply with California rate setting legal limitations such as Proposition 218. Prop 218 as it is referred to by most local governments and utilities was passed as a ballot initiative in 1996 and resulted in an amendment to the California Constitution that required changes in property oriented charges to be subject to the vote of the people. Water rate increases have been deemed to be covered by Prop 218 and as a result, utility customers are presented with an opportunity to stop a proposed rate increase. In many cases, the more pronounced impact Prop 218 has on pricing relates to the constitutional requirement it created for “proportionality” among rate payers. It formalized and codified the principle that a rate payer pays their proportional cost of service and thereby limits any clear cases of cross subsidization among customer classes. The result is that CA utilities are unable to charge some customers higher rates in order to generate funds to lower the rates of others or to directly fund an affordability assistance program. Utilities have turned to non rate revenue such as revenue from leasing water tower space to cell phone companies, to fund affordability programs.

State Financial Oversight

Over recent years, there has been increasing attention given to the fiscal health and fiscal sustainability of local governments in many areas of the country. While many state governments may have ultimate responsibility for backstopping troubled local governments, some states such as NC maintain strong on-going financial oversight of local utilities that directly impact pricing and fiscal policies. The Office of the North Carolina State Treasurer requires submittals of audited financial statements from all governmental utilities and reviews and analyzes financial condition on an annual basis. Local governments exhibiting evidence of financial hardship as indicated by metrics such as operating margin and days of cash on hand are often required to implement corrective actions in the form of rate increases or other financial policies.

Municipal Economic Regulation

Economic regulation systems are typically established at the state government level, however there are examples of economic regulation being implemented at regional and local level. Several of our partner utilities operated under a local rate of return framework in which the utility was required or expected to pay their governmental owner a rate of return just as investor owned utilities are expected to pay their stock holders a dividend. The city of Edmonton’s water utility, EPCOR, follows a performance based rate regulation that is monitored by the City.

2 Responses to “The Role of Economic Regulation in Influencing Financial Practices”

Water Rate Increases Among 1,961 Utilities in Six States in the Last Decade « Environmental Finance

[…] From a utility’s perspective, it seems that there are long-term financial and short-term customer service benefits to raising rates frequently: the annual rate increases can be small in size, avoiding customer rate shock, while enabling the utilities to accumulate greater rate increases over time than if the utility maintains the same rates for several years and requires a very large one-time rate increase. Is this what most utilities opted to do in these five states? Not quite. Only 25%-42% of utilities in each state adjusted their rates almost every single year in Georgia, North Carolina, Ohio and Texas, compared to 17%-36% of utilities that did not adjust rates or adjusted rates only once in those five years. Rate adjustments were much less frequent in Wisconsin where the Public Service Commission regulates rate increases for government-owned utilities. […]

Shane Hoffman

The email Stacey sent said to name a top business driver starting with “R”. My answer would be “Rain”!