Guest author Peiffer Brandt is Chief Operating Officer at Raftelis Financial Consultants.

“With our concerted conservation efforts, our focus on local water supply development, and the recession . . . we’re selling a lot less water than we originally anticipated,” said Maureen Stapleton, General Manager of the San Diego County Water Authority on July 26th. This is by no means a challenge unique to San Diego County—trying economic times and declining per capita usage have required utilities across the country to take a number of steps to maintain financial sufficiency.

The Water Works Board of the City of Birmingham (Board) has been particularly successful in combatting these challenges through the use of financial goals and policies, which guide the financial operations of the utility. As noted in a previous post, there are a number of different approaches available to utilities. Implementing and following the policies described below has helped the Board to not only maintain financial sufficiency, but to improve its financial situation such that it received a ratings upgrade from Moody’s during nationally and regionally challenging financial times.

One policy came about in 2004 when the Board, with an operating budget of approximately $56 million, had only $2 million in operating reserves. The Board had issued $300 million in debt in 2002 and $64 million in debt in 2004, and was projecting future debt issuances every other year. Board leadership recognized that this level of debt was not sustainable and urged staff to develop a plan to improve the utility’s financial position. The Board formally adopted reserve and pay-as-you-go (PAYGO) targets as identified by staff, shown below. The Board met the reserve targets in 2009, but chose to use reserves to fund a debt service reserve fund, as the surety provider had been downgraded. By 2011, the Board once again met the reserve targets. Though the Board has increased PAYGO funding, it has yet to meet the PAYGO target. This is due to the size of the capital plan and the potential rate impact of significantly increasing PAYGO (it was about 5% in 2004); however, the current financial projections indicate that the PAYGO target will be met in each of the next five years.

Reserve Targets

- Revenue Fund (12.5% of Operating Expenses + Debt Service)

- Capital Reserve Fund (20% of Average Annual Capital Plan)

- Demand Shortfall Fund (10% of Operating Expenses + Debt Service)

PAYGO Target

- Rate Funding of 20% of Annual Capital Plan

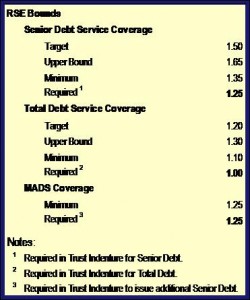

The following year, the Board formally adopted a rate stabilization and equalization (RSE) approach for setting rates. The Board’s approach was developed based on RSE approaches adopted by investor-owned gas and electric utilities in Alabama. Under this approach there is a minimum, a target, and an upper bound. For investor-owned utilities, the approach focuses on return, while for the Board, the focus is on coverage. The primary targets were for senior debt service coverage and total debt service coverage. The Board’s bond covenants require 1.25 and 1.00 coverage, respectively, but the minimum levels were set above the covenants. If the current rates result in either coverage ratio dropping below the minimum level, then rates must be increased so the coverage is at the target level (not just above the minimum level). If both coverage levels exceed their upper bounds, then rates should be lowered (as long as maximum annual debt service (MADS) coverage is maintained and the Board does not project an annual deficit).

In addition to formal financial policies, the Board has developed guidelines for the level of revenue to recover from monthly fixed charges. Following increases over the last ten years, the current monthly fixed charges are higher than those of most utilities, which provide revenue stability for the Board. As part of a comprehensive cost of service analysis in 2011, the Board identified a guideline of the monthly fixed charge revenue covering at least 95% of the Board’s annual debt service. This guideline was incorporated into the comprehensive cost of service analysis.

In addition to formal financial policies, the Board has developed guidelines for the level of revenue to recover from monthly fixed charges. Following increases over the last ten years, the current monthly fixed charges are higher than those of most utilities, which provide revenue stability for the Board. As part of a comprehensive cost of service analysis in 2011, the Board identified a guideline of the monthly fixed charge revenue covering at least 95% of the Board’s annual debt service. This guideline was incorporated into the comprehensive cost of service analysis.

Thanks in part to the financial policies and guidelines adopted by the Water Works Board of the City of Birmingham, the utility has improved its financial stability and has earned a ratings upgrade from Moody’s at a time when municipalities across the country are struggling to address the challenges associated with the “new normal.” Though it is recommended that each utility have a set of financial policies, the policies adopted and the guidelines identified by the Board are unlikely to be optimal for every utility. Instead, utilities should determine specific targets that are appropriate with respect to their unique financial situations.

2 Responses to “The Success Story of One Water Utility’s Financial Policies”

Trends in Operating Expenses Relative to Operating Revenues for Local Government-Owned Water Utilities « Environmental Finance

[…] be trending downwards or may have greater expenses than revenues. It is essential for utilities to track their own financial performance ratios and indicators over time and set targets in policies to monitor and ensure financial stability regardless of changing […]

Don’t Chicken Out on Financial Policies « Environmental Finance

[…] on Track with Finance Policies,” discussed some examples of getting buy-in on financial policies. Another post covered how the Water Works Board of the City of Birmingham used their finance policy to get an upgrade from the credit rating […]