Mary Tiger is the Chief Operating Officer of the Environmental Finance Center.

How would you like to get a check from your water utility instead of sending them one? This blog has included a few pricing alternatives that would better align a water utility’s objectives of full-cost pricing and conservation incentives. The PeakSet Base Model and the CustomerSelect Model are both comprehensive rate structures and pricing models. This blog post will discuss a slightly different approach; the WaterWise Dividend Model serves as a supplement to a utility’s pricing model rather than a stand-alone structure. It could really be implemented alongside any pricing model.

Owned by their members, cooperative organizations return profit to their “owners” once financial obligations are met. Many times these cooperatives return larger “dividends” to the “owners” that bought more of their product over time. Under the theoretical WaterWise Dividend business model, water utilities seeking revenue stability and efficient usage by customers would adopt an inspired model. However, rather than rewarding customers that used more, they would return conservation dividends to customers that used less. The definition of “less” could be established from a customer’s budget (for those utilities with budget-based rates) or relative to an individual customer’s historic use. Moreover, they could calculate a dividend according to any number of policies the utility wanted to promote, such as “peak shaving.”

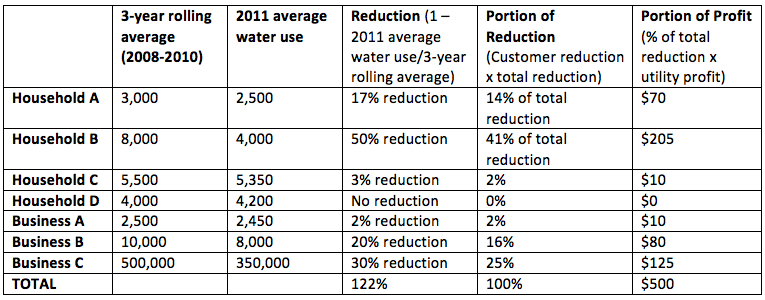

The table below shows a potential method for calculating dividends based on a customer’s recent water use compared to a rolling average of their historic demand. The example shows that the utility had a “profit” of $500. With a WaterWise Dividend, the utility can reward the customers that used less water in the past year relative to previous years water usage. In this example, “waterwise” is calculated relative to a customer’s own demand to encourage continuous improvement. This method is not the only way to calculate a “WaterWise Dividend. Utilities could choose to encourage steady water use by returning money to those customers with low peaking profiles or against any other “WaterWise” metric.

This model has the benefit of communicating to customers that the utility is a not-for-profit entity (in cases where this is true), as “profits” are returned to customers. It provides a positive way for utilities to interact with their customers, much like rebate programs, and it helps ensure that the financial goals are met above other priorities. It has even been extoled by utility officials as a valuable, temporary tool to use when adopting a new pricing structure to assure customers that the intent of the new structure is revenue neutrality.

Returning money to citizens is not unprecedented. In its January 2013 newsletter, DC Water announced that it would refund a one-time credit to customer bills because it finished Fiscal Year 2012 with a surplus. They anticipated a total system refund of $4.2 million at a rate of $0.10 per ccf and $1 per ERU (equivalent residential unit, a stormwater unit of measurement). Even though, this particular rebate was given to customers that use more, the model could be adopted, the formula adjusted for the aforementioned conservation incentive structure.

At this point, this model is more theoretical in nature. The Environmental Finance Center has not had the opportunity to extensively model this rate structure. It has, however, been presented to a panel of water utility finance experts at the American Water Works Association’s Annual Conference and Exposition in the summer of 2012. These experts included Doug Scott, Managing Director of Fitch Ratings’ US Public Finance Group; Janice Beecher, Director of the Institute of Public Utilities at Michigan State; and Jeff Walker, Director of Project Development for the Texas Water Development Board. The panel expressed hesitation about a few components of this model, including giving money back to customers. This model is only likely to succeed with a utility that maintains a conservative finance policy and meets goals before writing any checks.

One Response to “WaterWise Dividend Model”

George

The example shows that the utility had a “profit” of $500. woww :X