Source: U.S. Fish and Wildlife Service Southeast Region, Public domain, via Wikimedia Commons

By Kathryn Obenshain, Project Analyst, & Hope Thomson, Project Director at the UNC EFC

Providing environmental services can be expensive, and how those services are paid for is important. Often, recipients of those services, the customers, directly support the costs. However, in some instances, an environmental resource may lack a distinct set of customers, even though the resource is enjoyed or relied on by the public. In these cases of environmental public goods, finding strategies to financially support the resources over time can feel impossible. The long-term planning for maintenance of Lake Mattamuskeet in Hyde County, North Carolina, offers an example of the challenges facing environmental public goods. In partnership with the North Carolina Coastal Federation, UNC EFC has explored these challenges and sustainable financial management solutions in the form of interest-bearing accounts. Though these solutions were examined specifically for Lake Mattamuskeet, they may have applicability to public environmental resources in other communities.

Lake Mattamuskeet is the largest natural freshwater lake in North Carolina. As a national wildlife refuge which draws visitors for hunting, fishing and hiking due to its proximity to the coast, the lake hosts thousands of waterfowl every winter. As early as the 1700s, European colonists attempted to manipulate the lake, attempting to drain the lake and change its land use. Human interaction with the lake over the subsequent 300 years finally led to a 2016 designation as an impaired body of water for high turbidity and elevated levels of chlorophyll-a by the North Carolina Department of Environmental Quality (NCDEQ). Flooding and harmful algal blooms have contributed to declining water quality of the lake, and flooding has resulted in septic system failure and crop loss for nearby property owners.

To address these issues, the North Carolina Coastal Federation (NCCF) and other associated stakeholders prepared the Lake Mattamuskeet Restoration Plan. They found that an active water management program could be used to maintain a consistent water level in the lake, thereby reducing flooding events and improving water quality. While the stakeholder group anticipated being able to raise enough capital for the upfront costs of water management infrastructure, identifying strategies to pay for the operations and maintenance (O&M) of the project over its 20-year lifespan posed a significant challenge. Proposed fees levied on surrounding property owners proved to be an unviable solution. To explore this problem, UNC EFC researched options regarding sustainable, long-term financing solutions for O&M of water management at Lake Mattamuskeet.

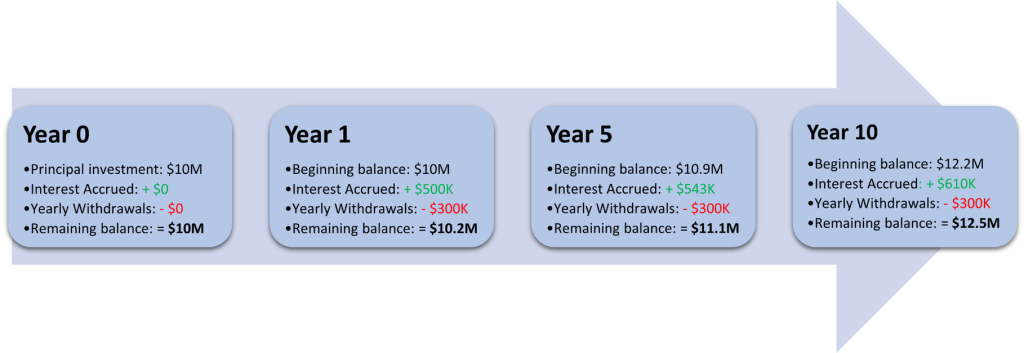

An endowment is a fund where only the interest earned on the corpus, or initial investment into the fund, is used for specific spending purposes as defined in the endowment policies. Thus, endowments are never spent down. Endowments are commonly used in conservation and mitigation projects because of this benefit. UNC EFC found an endowment for O&M suitable because the fund is available in perpetuity and does not require input over time. As the corpus is protected, spending cannot exceed the accrued interest of the fund (see Figure 1).

Figure 1: The performance of an endowment with a 5% interest rate over a 20-year period. In this example, the interest earned on the corpus or balance of the endowment exceeds to annual account withdrawals, so the overall balance grows with time. This example does not account for variability in investing outcomes or inflation.

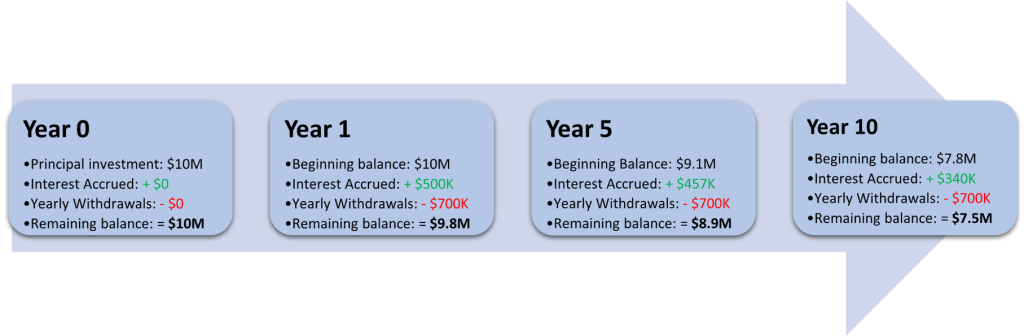

Finance Option #2: Expendable Trust

Like an endowment, an expendable trust is an interest-bearing account with restrictions on the use of the funds. However, an expendable trust is emptied over its lifetime—both the principal and accrued interest from investment disbursed for the benefit of the associated project in accordance with the investment terms and restrictions of the principal. Expendable trusts are used at the local government level and federal government level for special revenues, and by non-profits to manage designated funds.

Figure 2: The performance of a trust over 20 years with an interest rate of 5%. The fund will empty over time as withdrawals exceed accrued interest. This example does not account for variability in investing outcomes or inflation.

Both endowments and trusts are limited. Thorough payout and usage policies are necessary to maintain the integrity of the funds. Without such policies, fund managers could mismanage or misappropriate funds. It is also important to consider private versus public fund management. While private managers can have higher returns, they come with higher risks. Finding initial funding for the principal of these accounts is also a challenge. Most funding streams (i.e., grants) prioritize upfront capital costs and O&M expenses are not eligible. For this reason, investment by private donors is a common source of seed funding for both endowments and trusts, though this avenue may not always be available. Another option for seed funding may be through federal or state appropriations if the project has a wide enough impact and a legislative champion to gain traction within a lawmaking body.

Despite their limitations, these financing mechanisms offer the NCCF and stakeholders options to sustainably finance an active water management program over the next twenty years. Endowments and trusts are common models of fund management that managers can use to maximize funding over a set time period. While the use of these mechanisms for O&M funding in the water and wastewater sector is rare, these methods are more commonly used in land conservation contexts by non-profits such as The Nature Conservancy and best practices may be transferable. UNC EFC hopes that the financing mechanisms recommended for Lake Mattamuskeet inspire more conversation and thought about ways to sustainably finance O&M over time.

Need technical assistance? The UNC Environmental Finance Center is here to help!

The Environmental Finance Center at UNC-CH offers free one-on-one technical assistance for small water systems. If you have an interest in our support, fill out our interest form here or contact efc@unc.edu.

Visit https://efc.sog.unc.edu/technical-assistance/ to read more about technical assistance.

One Response to “Innovative Finance for the Restoration of Lake Mattamuskeet”

Karen Handmade

This article provides valuable insights into the financial management of environmental public goods. The case study on Lake Mattamuskeet highlights the challenges of financing environmental resources that lack distinct customers. The article presents endowments and trusts as two options to manage funds for operation and maintenance of environmental resources over the long term, and explains how these financing mechanisms work. Though the article is informative, it lacks engagement or interaction with the readers. Also, it would have been better if the article includes more examples of actual cases and how their financing mechanisms worked. In general, the article is informative, but it could have been more engaging to readers by providing more practical examples or interactive elements.