Jeff Hughes is the Director of the Environmental Finance Center and the Principal Investigator for the Water Research Foundation project mentioned in the post.

A recent report estimated that water utilities across the country will need $1,000,000,000,000 (count the zeros…) to cover their infrastructure needs. All signs indicate that most of this revenue is going to come from selling water services, and that as the needs of the industry rise, so too will the need for strategies to increase revenue in a predictable and sustainable manner. A recent analysis of rate and revenue trends indicates that relying on simple price increases on the amount of water sold may be neither a predictable nor sustainable revenue strategy.

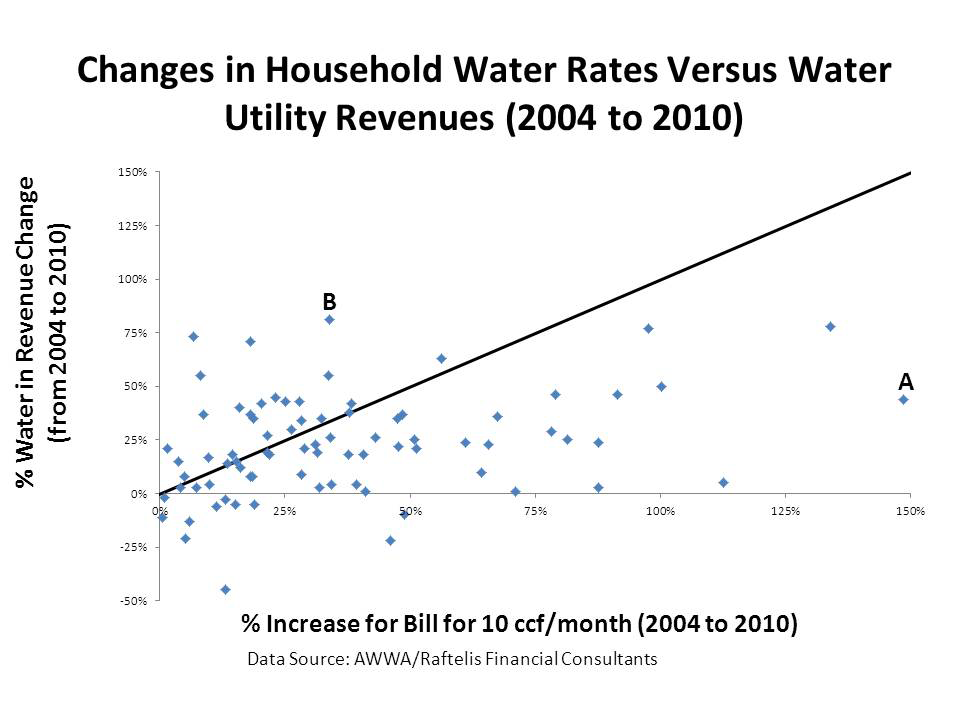

As part of a Water Research Foundation research project, a team of researchers from the Environmental Finance Center at UNC (EFC) and Raftelis Financial Consultants (RFC) is studying revenue and pricing trends to better understand where the revenue for these new projects will come from and whether utilities will need new business models to meet future needs. The project team looked at revenue and rate setting trends for a group of utilities from across the country participating in the AWWA/RFC rate survey to see how operating revenues and rates have changed over time. Specifically, we wanted to see how close to a 1 to 1 relationship there was (represented by the black line in the chart). In other words, if a utility subjected their customers to 50% of rate increases over a 6-year period, did their total revenue from all their customers go up 50%, less than 50%, or more than 50%? Due to the elasticity of demand, we would not expect an exact match, but seeing where utilities fall on this graph tells a story of the multitude of operating environments of the industry.

As part of a Water Research Foundation research project, a team of researchers from the Environmental Finance Center at UNC (EFC) and Raftelis Financial Consultants (RFC) is studying revenue and pricing trends to better understand where the revenue for these new projects will come from and whether utilities will need new business models to meet future needs. The project team looked at revenue and rate setting trends for a group of utilities from across the country participating in the AWWA/RFC rate survey to see how operating revenues and rates have changed over time. Specifically, we wanted to see how close to a 1 to 1 relationship there was (represented by the black line in the chart). In other words, if a utility subjected their customers to 50% of rate increases over a 6-year period, did their total revenue from all their customers go up 50%, less than 50%, or more than 50%? Due to the elasticity of demand, we would not expect an exact match, but seeing where utilities fall on this graph tells a story of the multitude of operating environments of the industry.

As the chart shows, the revenue picture varied across the sample, with some utilities even experiencing a net decline during the period despite rate increases. However most of the utilities saw some increased revenues, especially in the 25 to 50% range. There are multiple explanations for changes in revenue – changes in weather may have led customers to increase or decrease their use or the utility may have added or lost customers. The most direct factor that influences revenue, and one that utilities feel they probably have the most control over relates to the price they charge their customers for service. Despite lots of interest in looking at new pricing structures that decouple revenue from volume sold, the majority of utilities still rely on volumetric charges for the majority of their revenue.

Many customers may assume that if their rates go up 10% in a given year or 60% over a period of 6 years, their utility revenues will go up an equal amount. During periods of low inflation, customers may even ask what their utility is doing with all the “excess” revenue they’ve collected from recurring price increases. Unfortunately, as most utility CFO’s have come to realize, and as the figure above demonstrates, a highly fought battle for a 10% rate increase more than likely will not lead to 10% revenue increase. Our analysis shows that the majority (64%) of these utilities fall below the 1 to 1 line between revenue and price increases. In other words, the utilities in the sample have raised the price of water more, and in some cases considerably more, than any increase in revenues. The drop in per customer usage and the decline of customers has made the relationship with rate increases and revenue increases less than satisfying for many utilities.

Take the example of Utility A — they saw their revenues increase by only 30% during a period where they increased the bill for 10 ccf by 150% — most likely an outcome that has led to public concern if not out-right rebellion. On the other hand, Utility B had their 30% rate increase contribute (along with a likely growth in customers and sales) to a 85% increase in revenues. The analysis illustrated the radically different operating environments that utilities operate in and how diverse revenue strategies will need to be to meet the needs of specific circumstances.

The math behind many of the dots is most likely frightening simple – fewer customers buying less water requiring utility to raise unit costs higher and higher to generate the revenue they need to meet their fixed costs. (This analysis does not take into consideration that for many utilities the consumption of their residential customers have declined so that a customer that bought 10 ccf in 2004 likely bought less than 10 ccf in 2010. To the extent data is available, future analyses will take into consideration utility specific changes in consumption.)

How worried a utility should be about their business model depends on their circumstances, but certainly some of the utilities above should be concerned about the sustainability of their current pricing structure and may be interested in looking for alternatives. As part of our research project, we will be testing a range of models such as this one that may address some of these challenges.